Ways to Monitor Your Ecommerce Site for Credit Card Fraud

[ad_1]

According to Michigan Retailer Association’s review of retail gross sales presented in its 2021 Get Nearby Research, nationwide ecommerce product sales grew from 8.8 percent of overall retail product sales in 2017 to 10.7 % in 2019, and then jumped once again to 13.6 per cent in 2020. Though this info is really hard to delineate at a state-amount, there’s no question that Michigan’s retail sector has most likely undergone a similar transformation.

Amid the COVID-19 pandemic, adding ecommerce as a mode for promoting has been important for many Michigan suppliers. With no it, much more stores would not have survived the pandemic.

As on line revenue grow, so does fraud

As a great deal as shops have benefited from ecommerce revenue, on-line credit rating card fraud has jumped appreciably across the U.S. According to LexisNexis, U.S. ecommerce retailers documented a 140 % improve in fraud assaults considering the fact that 2020. On top of that, in accordance to a current report in Business Insider, card-not-current (CNP) fraud is predicted to grow by 14 percent in the future 4 years.

A single of the most popular means cyber criminals get stolen credit score card numbers is by the dim internet. Most check out a web-site on the darkish net and get stolen credit history playing cards in bulk with the aim of screening them to discover the kinds that function. In 2019, there were being at the very least 23 million stolen credit rating card quantities for sale on the dim world-wide-web. That selection has only amplified considering the fact that then.

What does this fraud indicate to your organization? Imagine extra chargebacks, penalties, shed revenue, and a new popularity amongst criminals that your business is an simple goal.

I say this usually: fraud avoidance is a journey, not a location. Cyber criminals are quite innovative and they adjust procedures routinely and generally. There are, nonetheless, 3 steps you can just take that will support you reduce fraud for the duration of a transaction. They can expose a opportunity credit score card theft in the earning.

- Do you consider notice if your terminal activities an EMV chip malfunction?

Although most of this post is linked to ecommerce, one particular of the techniques that bad fellas use stolen card quantities is by using a facial area-to-experience transaction that is not “dipped” into the chip reader.

Despite the fact that most retailers use an EMV chip reader, terminals are established up to allow for transactions to be processed employing a magnetic strip to accommodate more mature cards with no chips, or playing cards with malfunctioning chips. This is the loophole that criminals are now exploiting.

If a negative person has a good card amount (and the related facts from the mag stripe), they can encode that on a reputable card and then hurt the card’s EMV chip. This will force your terminal to accept a swipe (with the stolen card range on the magazine stripe, as a substitute of the reputable card quantity).

When they make a acquire, they insert the card in the chip reader, which will report an mistake mainly because the chip cannot be go through. Then, they will inform the clerk that they are possessing problems with the EMV chip on their card and question if they can entire the transaction by both swiping the magnetic strip or owning the clerk key in the account number, bypassing the EMV chip reader all jointly.

Choose notice, you need to have to be vigilant with your staff members about always using an EMV chip reader. The important card networks have very clear rules about this. If a merchant allows a customer with an EMV chip credit card to make a buy by swiping the card in lieu of working with the chip reader, any chargebacks filed towards the transaction will routinely be uncovered in the cardholder’s favor.

Alert your personnel to acquire note when this takes place, particularly if it is a large-ticket range this sort of as jewelry, appliances, or a personal computer. If your EMV chip reader continues to fall short, it may well be time to improve your procedure.

- Does your website demand a three-digit protection code for all on the web transactions?

According to a 2021 Nilson Report on credit score card fraud, the amount of income lost to card-not-present fraud in 2020 was 6 periods greater than what retailers missing just one particular calendar year earlier. Therefore the will need to make confident that any buys manufactured on your web site require a stability code.

A credit rating card security code, generally acknowledged as the card verification worth 2(or CVV2) is the 3 or 4 -digit code ordinarily identified on the back of a credit score card. The CVV2 offers an added layer of security by verifying that the purchaser is in possession of the card.

To continue to be PCI compliant, you are not allowed to retailer CVV2 codes on your process. This can help in preserving buyers from a details breach and can make it hard for cyber criminals to get a customer’s CVV2. Not complying with world-wide PCI Info Stability Requirements could consequence in hefty fines or even even worse – the cancellation of your merchant processing access by the payment processor.

- Does your web page involve a CAPTCHA as element of the checkout approach?

1 of the problems that undesirable men have is figuring out if the card numbers that they purchased on the darkish net are however lively and “good.”

A prevalent on-line procedure made use of by criminals is obtain web-sites to test a team of stolen cards by conducting lower-amount of money transactions, typically $1 or $2 to find the playing cards that are still active. This kind of account screening is known as “card tumbling.” One of the key consequences of being a victim of a card tumbling attack like this is the sizeable expenses your account can manifest if the scale of the assault is considerable. Some illustrations of expenses involve authorization, clearing and settlement, interchange, and gateway transactions.

Anything at all you can do to slow down the method of obtaining an authorization attempt on a transaction retains card tumblers at bay. This is wherever such as a CAPTCHA as aspect of your on line checkout course of action plays a essential function. In accordance to Dictionary.com, the origin of CAPTCHA stands for “completely automated public Turing test to notify pcs and people aside.” It is a variety of challenge-response check employed to identify no matter whether the person is a human or a bot. To move the check, users ought to interpret distorted text by typing in correct letters into a sort area. In the situation of a re-CAPTCHA, the person is needed to discover a set of objects in a picture.

Although CAPTCHAs obtain their reasonable share of critics, they’ve done a great job in protecting ecommerce sites from brute force assaults.

As stated at the starting of this write-up, this process of safeguarding your self is a journey, not a location. It is some thing that you must be spending notice to routinely.

As always, if you have inquiries about this concern or any other service provider processing difficulty, be sure to do not hesitate to make contact with our shopper provider workforce at 800.563.5981

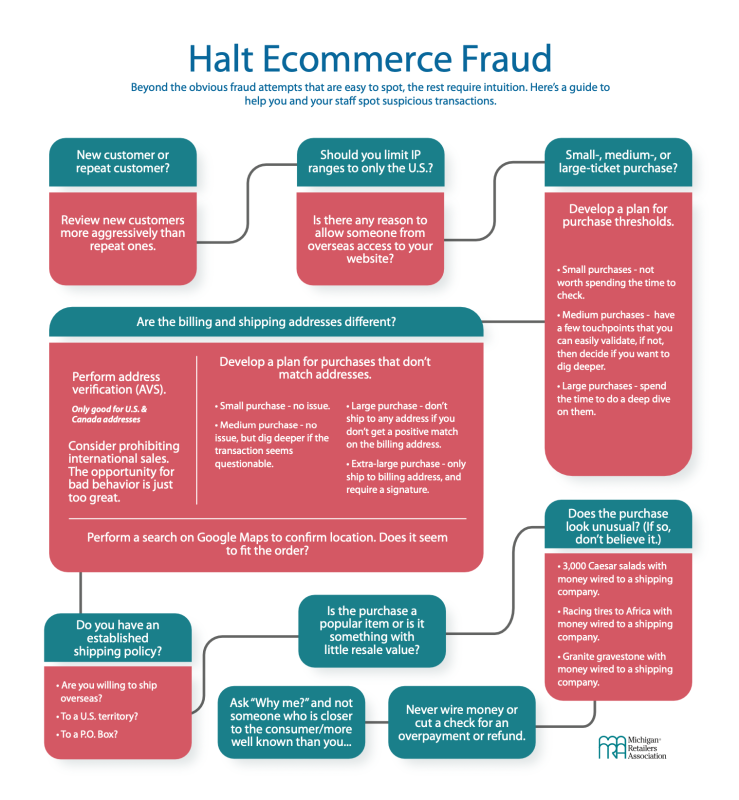

Use this Ecommerce Fraud Choice Tree graphic to support you and your team location suspicious transactions.

[ad_2]

Resource connection